Politicians, government, civil servants, regulators. We pay their wages. They work for us, don’t they? So why does the voice of the consumer, the citizen, the customer so often seem to be ignored or become lost when the government makes new policies or passes new legislation. DAB radio seems to be a case in point.

The government had convened the Digital Radio Working Group [DRWG] in 2007 to consider:

• what conditions would need to be achieved before digital platforms could become the predominant means of delivering radio?

• what are the current barriers to the growth of digital radio?

• what are the possible remedies to those barriers?

The Group met for a year and published its Final Report six days before Christmas 2008. It had created a number of sub-groups to examine specific aspects of digital radio. One of these, the Consumer Impact Group, submitted its own report to the Working Group in November 2008 to inform its Final Report.

The Consumer Impact Group’s recommendations about DAB radio make sober reading and carry as much gravitas, maybe more, now as when they were written a year ago. To quote directly and extensively from its report:

“The group is concerned that the case for digital [radio] migration has not been made clearly enough from the point of view of the consumer. While it is clear what the rationale is for the radio industry, the group would like to see a compelling argument as to why digital migration is desirable for consumers and what its benefits would be for consumers.”

“The group also considers that the proposed migration criteria of 50% of all listening through digitally enabled devices is too low, and disproportionately affects disadvantaged groups who are less likely to be represented in the first 50% to take up digital radio. The group would therefore like to see the 50% figure analysed in more detail and a stronger case made for it, before it is adopted by the full DRWG, to ensure this is not the case.”

“The group notes that neither the market nor consumers are currently prepared for migration at this stage. Information provided to the group shows that take-up varies from region to region and amongst demographic groups. Therefore, the group recommends that if digital migration proceeds, a help scheme will be essential to assist those where the cost of migration is significantly greater than the benefit. The information provided by the cost benefit analysis for the more vulnerable social groups will be an essential element in considering where and how a help scheme is best delivered.”

“The group believes that further research should be undertaken to examine the extent of ownership and usage of analogue and digital radio particularly amongst disabled people, older people, people whose first language is not English and consumers from low income households. The research must be structured and use appropriate methodology to capture information on those over 65 and those over 75. The findings should be fed into plans to protect the consumer interests, i.e. for a help scheme, for effective labelling, for information and education campaigns and for the development of easy-to use products.”

“The group urges caution with migration to digital radio should the uptake amongst older people, disabled people and low-income households be found to be low or should the costs be found to be prohibitive for these groups.”

Commenting on DAB radio take-up and the proposed digital migration criteria, the report said:

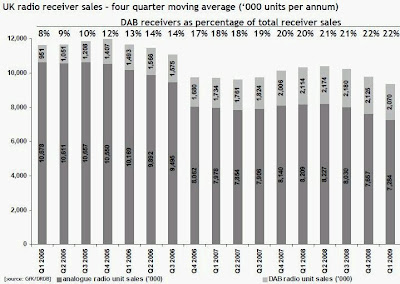

“The RadioCentre was asked to present figures, drawn from the existing Rajar and DRDB figures, setting out the current information on the number of DAB sales, household penetration and listening, defined by region, age and social class.”

“The figures, which are annexed to this report at B [but excluded from the published version], show a number of interesting trends. For example sales, penetration and listening to DAB vary across the UK. Generally speaking, listening and awareness of DAB is highest in London and the South East, and the English Midlands. These have been the areas of longest DAB broadcasts and the widest choice of stations.”

“When awareness and penetration are broken down by Socio-Economic Group and age, there does appear to be a divide. The figures show that consumers in lower income groups are considerably less likely to own a DAB set than other social groups. Even when owning a DAB, in some areas weekly listening to DAB by the over 65s is very low at less than 10%.”

“The main conclusions to be drawn from this research is the general low level of ownership and listening by the over 65s compared to other age groups, and the low listening figures for consumers in the lower socio economic groups. This perhaps reflects that financially lower income groups are finding the price of sets a barrier, whilst for older groups, despite having sets, over 65’s may find DAB radio’s less easy to use than analogue sets, or perhaps prefer the traditional use of their analogue sets.”

“Whilst recognising that universal DAB coverage is not achievable, the group considered that after migration, DAB coverage for UK-wide stations and stations for the nations should be equivalent or better than that available for analogue radio at present.”

“The group stressed the importance of encouraging availability and use in cars, and noted that it would be virtually impossible to meet any listening criteria without addressing the issue of take up in cars. The group feels this should be a priority for the full DRWG.”

On the topic of research, the Consumer Impact Group commented:

“More and wider research is required, particularly about the ownership and usage of analogue and digital radio amongst those people with disabilities, people whose first language is not English, older people (both over 65s and over 75s) and those in low income groups. This additional research, when used together with the RadioCentre research and Rajar figures should be used to guide future work in this area, particularly around take-up, equipment features, programming and a help scheme. The group feels that there is an opportunity here to ensure that future work is based on comprehensive and reliable evidence and analysis. The findings should be fed into plans for any help scheme, for effective labelling, for information and education campaigns and for developing easy-to use products. Where it doesn’t already, this research should also take into account ways of listening to digital radio other than through a DAB enabled set, for example via the internet, digital terrestrial and satellite television, which may provide a significant proportion of the growth in the future.”

The Consumer Impact Group’s recommendations included:

• “We believe, that before migration could begin, additional research into radio users who are disabled, older people (both over 65 and over 75) and consumers from low income households is essential, since these people are likely to require particular assistance with migrating to DAB. This research should inform the development of plans for a help scheme, for effective labelling, for information and education campaigns and for developing easy to use products.”

• “In the absence of the finalised cost benefit analysis at this point in time, the group recommends that the cost of converting to digital radio for the average household, as well as the affordability for low income groups should be investigated. In addition, the current take-up amongst older people, disabled people and low-income households needs to be investigated. The group urges extreme caution with migration to digital radio should the uptake in these groups be found to be low or should the costs be considered to be prohibitive by any of these groups, unless an appropriate help scheme is in place.”

Analysis. Research. Cost benefit analysis. Comprehensive and reliable evidence. All were considered to be very important by the Consumer Impact Group.

However, when the 26-page Final Report of the Digital Radio Working Group was published in December 2008, it did not include a single graph, a single numerical table or the results of any commissioned consumer research. Neither were such data attached in appendices.

The Final Report of the Digital Radio Working Group did recommend that “the government should conduct a cost benefit analysis of digital migration”. The government accepted this recommendation. One might think that this would be an urgent imperative, given that proposed legislation on DAB radio in the Digital Economy Bill is about to be debated in Parliament.

Wrong! The government has stated explicitly that it is “committed to a full cost benefit analysis of the Digital Radio Upgrade programme before any Digital Radio Upgrade is set” which would include “the timings and costs to consumers”. But the government has stated that “this is likely to begin in 2011”.

What? The government wants a huge (some would say impossible) commitment from the UK radio sector and from the British public to forge ahead with migration of radio listening to DAB, even though its own full cost benefit analysis of pursuing that policy will not be STARTED until 2011.

Is this not mad? Are our public servants working for us? Does the consumer viewpoint on these issues count for nothing?