“It’s a simple equation. The BBC has had an unfair share of the analogue spectrum but digital enables the commercial players the space to compete on a much more equal footing.”

Steve Orchard, operations director, GCap Media in Music Week, 9 December 2006, p.10.

For almost an eternity, the UK commercial radio industry has complained vociferously that it has been discriminated against because the BBC has the use of more analogue spectrum than it does. The argument has been made repeatedly that commercial radio will always ‘under-perform’ against the BBC as long as the BBC is allocated more space on the FM waveband. To support this argument, its proponents hold up the fact that the BBC has four national channels on FM, whilst commercial radio has only one (they choose to ignore the fact that, additionally, the BBC has 40 local stations on FM, whilst commercial radio has 200+ local stations on FM).

When DAB radio arrived a decade ago, there was a widely held notion within commercial radio that the new technology provided an opportunity to even the score with the BBC. Whereas the government was unlikely ever to re-allocate analogue spectrum to provide equal amounts to the BBC and its commercial competitors, in digital spectrum the commercial sector pushed ahead with DAB (before the BBC did) and a successful ‘land grab’ rewarded it with much more DAB spectrum than the BBC. The prognosis was that, in the future, DAB would replace analogue usage, and that the commercial sector’s dominance of digital spectrum would eventually reward it with the dominance over the BBC it craved.

It is difficult to say precisely how much more DAB digital spectrum the commercial radio sector has than the BBC. With DAB, there is a degree of flexibility because you have the choice to either use a section of spectrum for one station (in high audio quality) or for two or three stations (in lower audio quality). Commercial radio and the BBC each have one national DAB multiplex (though their coverage of the UK is not identical). Additionally, commercial radio has 46 operational local and regional multiplexes that cover the most populous parts of the UK. These multiplexes probably more than double commercial radio’s superiority over the BBC in DAB spectrum. But then commercial radio also leases some space on its local multiplexes to the BBC for its local stations. This makes comparisons complicated.

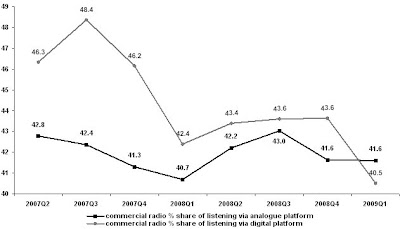

Whatever the detail, it is obvious that commercial radio has control of far more DAB digital spectrum than does the BBC. To compound the situation, commercial radio also has control of far more Freeview digital radio spectrum than does the BBC. So, as had been hotly anticipated a decade ago, surely by now commercial radio must have the upper hand over the BBC in digital radio listening. The answer is ‘yes’ – commercial radio had almost been winning the digital race – and ‘no’ – it is no longer. In fact, the latest RAJAR data show that commercial radio’s share of digital listening (40.5% in Q1 2009) has fallen below its share of analogue listening (41.6% in Q1 2009) for the first time.

These data cover all digital listening to all stations available on digital platforms (including simulcasts of analogue stations). However, because of the RAJAR methodology, the data do not include time-shifted listening to ‘listen again’ and ‘podcast’ radio content. These are both areas in which the BBC offers far more content (and markets it much more heavily) than does commercial radio. If it were possible to incorporate this time-shifted listening into the above data (which it is not), it is likely that commercial radio’s share of listening would be much lower than its present 40.5% via digital platforms.

The long-held belief that commercial radio would somehow automatically win the war with the BBC on digital spectrum purely because it controlled more spectrum had always been mistaken. This belief assumes, somewhat bizarrely, that each consumer randomly spins their radio dial and then leaves it on whatever frequency the radio has landed on. Only by utilising such a random system of selection would usage ever be proportionate to the amount of spectrum. Unfortunately for the commercial radio sector, consumers are not mindless idiots. Anyone endowed with an Economics GCSE can easily see the gaping holes in this notion. Apparently few in the commercial radio industry could.

Consumers make choices and the radio station they decide to listen to is the one from which they expect to derive the most ‘utility’. This is why ‘content is king’. This is why BBC Radio Two and Three both use equal amounts of spectrum, but the former has a 16% share, and the latter 1%. And this is why one fantastic radio station will always attract more listening than any number of mediocre ones (viz Atlantic 252, Laser 558, Luxembourg 208). It is not about how much spectrum you occupy, but about what you do with it. Consumers are motivated to listen by your content, not by your spectrum.

For commercial radio, after a decade of trying to convince itself and others that its abundance of digital spectrum would somehow entitle it to automatically trash the BBC, the dream (and it was a dream) is now over. Belatedly, it is back to the drawing board. As the BBC, PrimeTime, Bauer and Planet Rock have demonstrated, if you put some content on digital radio that consumers want to listen to, then they will listen (if they are made aware it exists through a marketing campaign). Digital radio would have a lot more listeners today if that simple truism had been understood by more players in the commercial radio sector a decade ago.