In France, Le Monde newspaper published an opinion piece last week written by Pierre Bellanger, founder and president of commercial radio group Skyrock, and Sylvain Anichini, former director general of state-owned Radio France:

LET’S NOT MESS UP DIGITAL RADIO

The powers that be are asking themselves a question about the transition to digital radio – if digital terrestrial television is a success, why would the transition to digital terrestrial radio not be a similar success?

In reply, experts have suggested there are differences between digital television and digital radio. Digital television is nationally operated and is being introduced nationally, whereas digital radio is being planned region-by-region with no certainty for radio operators who must apply for digital spectrum. Digital television offers three times as many free channels as analogue, whereas digital radio offers only a marginal increase over the wide choice available on analogue. Digital television was launched with a new generation of TV receivers – flat screens and high definition – and with adaptors for existing equipment. This is not the case for digital radio – digital radio receivers are as sexy as bricks and 140 million analogue radios will have to be thrown away.

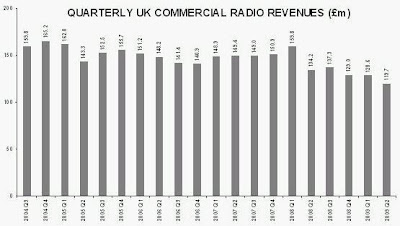

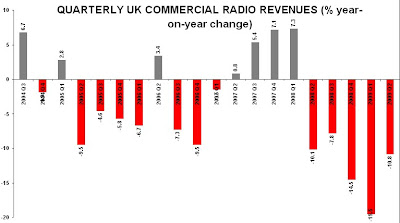

Furthermore, digital television launched just when the medium was exploiting new sources of advertising revenues – once the preserve of radio – and when purchasing power was growing in line with the economy. Whereas, the transition to digital radio is being implemented just as the radio industry is reeling from the 2008 financial crisis and household spending is in decline. Finally, the television sector received significant financial help to fund its digital switchover. For digital radio, the subject of funding has been mentioned, and even said to be desirable, but there has been no promise to date. Public funding is not there to support the public will.

These facts have not stopped the powers that be, who have promised to overcome these obstacles. Driven by legislation, they have proceeded towards the launch of digital radio by involving key radio industry players in their strategy to select both a digital radio transmission standard and the most appropriate waveband to use. Applications have been submitted by radio opertaors for the first digital radio areas and there will be a selection process, just as for analogue radio, with licences awarded to the candidates of choice.

This process involves a substantial number of declarations of intent as to the magic of ‘digital’ in a concept synonymous with modernity. Perhaps we are forgetting somewhat that the CD, also digital, belongs more to the past than to the future ….

We are where we are. At the moment of truth when ‘poetry’ must give way to number-crunching and it seems that national digital radio transmission will cost at least 3 million Euros per annum, adding up to a total 50 million Euros per annum for the main radio groups. Additional transmitters are likely to need to be added to alleviate pockets of poor reception. And the absence of real competition between transmission providers offers little hope of reducing these costs. Finally, no new tangible sources of radio advertising are anticipated, and broadcasting will begin without a significant body of digital radio receivers in the market …

This kind of investment – more than 250 million Euros over seven years – might be justified if it could be amortised over two future decades that offered technological and economic stability. But we presently live in the midst of a complete revolution: the emergence of mobile internet access. This offers consumers the ability to connect anytime, anywhere, without interruption, to the internet via the airwaves.

The logic of the mobile internet is redefining the physical distribution of information and is disrupting traditional media and telecoms. The fixed internet has already changed our present, and the mobile internet is opening up the future. Radio is fully participating in this mutation, with radio distribution adapting to the internet protocol with ‘IP radio’.

The future is already in our hands: it is the iPhone. This revolutionary handheld device has allowed the internet to break into the mobile environment via existing communications networks. It provides access to thousands of radio stations, personalised music choices, and the user’s own media library.

Access is either through telecoms networks or through free Wi-Fi available at home or from millions of free wireless terminals. The multi-standard chip lets us forget about having to make a choice between network connections. We click and listen to our favourite radio station, that is all there is to do. ‘IP radio’ offers every radio station that is available via a conventional transistor radio.

The internet handset is connected to the car radio, the home hi-fi, the radio alarm clock, and chips that connect us to the internet on the move will be everywhere.

Already one and a half million iPhones have been sold in France. An entire industry, in less than two years, has caught up with touchscreen technology and IP handsets. It is true that the bandwidth, like the handsets, remain expensive, and telecoms networks must gear themselves towards new demands, but the trend is there: prices will fall. Besides, on the horizon is a converged pricing structure combining fixed broadband and mobile internet access in a package that offers unlimited usage. Therefore, how can we possibly build a viable market for digital radio receivers when the replacement cycle for radios is ten years, whilst that for (subsidised) mobile handsets is 18 months?

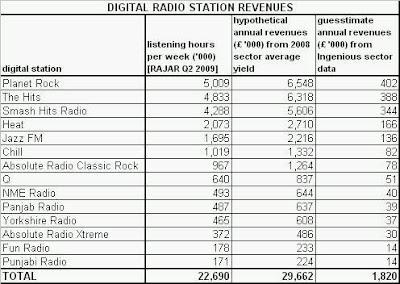

Unlike digital terrestrial radio, there is a business model for radio delivered by IP – it allows listeners to demand and receive advertisements specifically tailored to specific audience needs. This is internet audio. Listening is measured in real time and advertising space is traded in virtual marketplaces. IP-delivered radio has produced an unprecedented explosion of creative initiatives, supported by new economic models suited to micro-enterprises – look at the success of Radio Paradise.

What had once been little but a visionary thought is now beginning to make headway as a global standard – mobile internet is the new deal. It is the antithesis of the existing strata of broadcast networks specific to each medium (radio, television). In the future fragile economic landscape, where the concerns of preserving energy and the environment are becoming priorities, can we continue as if nothing has happened?

Careful thought by the powers that be should lead them to take account of these facts and to re-focus their administrative processes which risk becoming bogged down without public subsidy. Why not consider better use of digital networks that already exist? Digital terrestrial television which already allows radio, for example? And, whatever the case with radio, promote mobile internet access in the broader context of migration to a ‘digital’ France.

The planned migration to digital terrestrial radio was not a mistake, but a ‘future of delays’ overtaken by a technological revolution which has surprised entire industries. Recognising this does not take anything away from those who have defended their point of view. A change of course is never a mistake when it allows you to avoid hitting the reefs.

[unabridged]