“We are making a clear statement of Government and policy commitment to enabling DAB to be a primary distribution network for radio” and “we will create a plan for digital migration of radio…….”

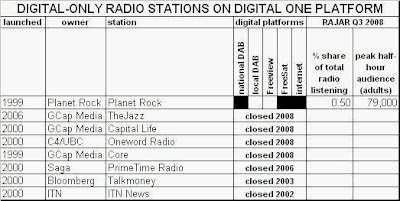

This coincidence of timing between Lord Carter and RAJAR offered a perfect PR opportunity for the radio industry to emphasise just how successful its drive towards digital migration has been to date. But where exactly were the stories of dazzling digital radio success?

The RAJAR

press release noted that “digital listening hours [are] up 10% year on year” and “DAB ownership [is] up 35% year on year”. The brief RadioCentre press release avoided mentioning digital radio altogether. The BBC press release only mentioned digital radio in the context of its digital-only stations, but nothing specifically about the DAB platform. The Digital Radio Development Bureau [DRDB] press release was headed “Digital listening and hours up” and noted that “radio listening via a digital platform has increased year on year while remaining stable quarter on quarter”. The Bauer Radio press release avoided all mention of the DAB platform. So, not much evidence today of digital radio’s success.What about the DRDB’s statement that digital platform usage is “stable quarter on quarter”? Only two months ago, DRDB

announced the launch of a joint BBC and commercial radio Christmas marketing campaign “aimed at driving sales of DAB radios this season”. Although DAB radio hardware sales in the final quarter of the year had subsequently proven disappointing, might not the campaign have also encouraged some consumers to use the DAB platform more, if they already owned the DAB hardware?Apparently not. Whilst it is true that the latest RAJAR data show increases in listener usage of digital platforms year-on-year, that growth is nowhere near fast enough to make DAB “a primary distribution network for radio” anytime soon, as Lord Carter has advocated. The Digital Britain report has simply decided to endorse wholesale the earlier proposals contained in the Digital Radio Working Group’s

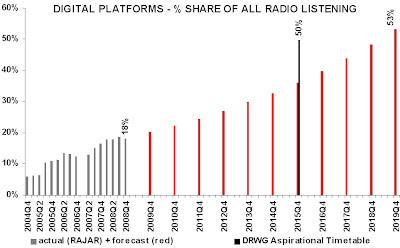

Final Report, as it stated:“We will create a plan for digital migration of radio, which the Government intends to put in place once….. 50% of radio listening is digital”.

Furthermore, the Report pledged the Government to “work with industry to satisfy the migration criteria by 2015 and, where possible, identify initiatives which could bring forward the migration timetable”.

These are bold words. The RAJAR data shows digital platforms’ share of listening was 18.3% in Q4 2008, down from 18.7% the previous quarter, but up from 16.6% year-on-year. If this last year’s rate of growth is projected and compounded into the future, the 50% criterion would not be attained until 2019. To achieve the desired outcome by 2015, let alone before 2015, would necessitate a remarkable change in radio listening habits, the likes of which have not been witnessed to date.

These are bold words. The RAJAR data shows digital platforms’ share of listening was 18.3% in Q4 2008, down from 18.7% the previous quarter, but up from 16.6% year-on-year. If this last year’s rate of growth is projected and compounded into the future, the 50% criterion would not be attained until 2019. To achieve the desired outcome by 2015, let alone before 2015, would necessitate a remarkable change in radio listening habits, the likes of which have not been witnessed to date.

DAB is presently, by far and away, the most significant platform for digital radio listening (the others are digital TV, the internet and ‘digital’ mobile phone). As a result, Lord Carter’s anticipated increase in digital radio listening is heavily dependent upon consumer purchase of DAB radio receivers, rather than simply a switch from one available technology to another. However, the disappointing sales of DAB hardware last quarter point to sales growth being unlikely to move into positive territory during 2009. DAB receiver sales in 2008 did not meet the forecast made by the DRDB in 2007, let alone the more optimistic forecasts of previous years. The DRDB did not publish a sales forecast in 2008, but there is little doubt that the growth trend is beginning to look more linear than exponential. DAB receiver uptake is presently the main pre-requisite for growth in digital radio usage and one that is looking increasingly uncertain.

DAB receiver sales in 2008 did not meet the forecast made by the DRDB in 2007, let alone the more optimistic forecasts of previous years. The DRDB did not publish a sales forecast in 2008, but there is little doubt that the growth trend is beginning to look more linear than exponential. DAB receiver uptake is presently the main pre-requisite for growth in digital radio usage and one that is looking increasingly uncertain.

The other essential factor is consumer usage, not just ownership, of DAB radios. If owners continue to listen on their other analogue radios (the average household has six radios) rather than via DAB, it will still take a long time to reach the 50% threshold. It surely must be the exclusive content available on the DAB platform that will promote its usage (though other factors such as DAB’s ease of use and signal strength will play a part). However, 2008 saw a significant reduction in available DAB content, precipitated by GCap Media/Global Radio’s decision to withdraw almost entirely from the DAB content market.

Somewhat surprisingly, given this reduction in available content, the DAB platform’s share of commercial radio listening showed a significant increase last quarter (to 9.9% from 9.2% the previous quarter) but the aggregate usage of digital platforms has stayed remarkably flat during 2008 at around 19%. Put simply, we are not seeing much, if any, growth in digital platform usage for commercial radio. (NB: much of the apparent growth in the graphs above and below derives from re-distribution of earlier ‘unspecified’ respondent data in recent quarters.)

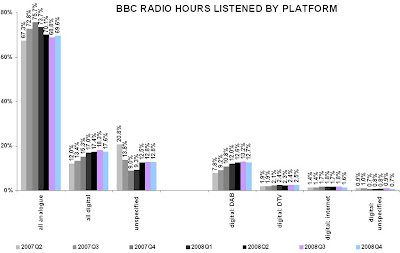

Somewhat surprisingly, given this reduction in available content, the DAB platform’s share of commercial radio listening showed a significant increase last quarter (to 9.9% from 9.2% the previous quarter) but the aggregate usage of digital platforms has stayed remarkably flat during 2008 at around 19%. Put simply, we are not seeing much, if any, growth in digital platform usage for commercial radio. (NB: much of the apparent growth in the graphs above and below derives from re-distribution of earlier ‘unspecified’ respondent data in recent quarters.) If commercial radio’s success with digital platforms seems ‘stuck’, then the BBC could be in an even worse position. In the last quarter, usage of both the DAB and internet platforms declined, leading to old fashioned analogue radio having accounted for a greater proportion of listening than in the previous quarter (up from 68.8% to 69.6%). This is particularly alarming, given the BBC’s much more extensive cross-promotion of its digital platforms across all media, and given the integration of radio into the BBC iPlayer in 2008. It is true that one quarter’s data alone might only prove to be a statistical aberration, but it is worrying news to arrive on the very day that Lord Carter chose to pin his colours to the ‘radio must be DAB’ mast.

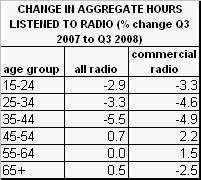

If commercial radio’s success with digital platforms seems ‘stuck’, then the BBC could be in an even worse position. In the last quarter, usage of both the DAB and internet platforms declined, leading to old fashioned analogue radio having accounted for a greater proportion of listening than in the previous quarter (up from 68.8% to 69.6%). This is particularly alarming, given the BBC’s much more extensive cross-promotion of its digital platforms across all media, and given the integration of radio into the BBC iPlayer in 2008. It is true that one quarter’s data alone might only prove to be a statistical aberration, but it is worrying news to arrive on the very day that Lord Carter chose to pin his colours to the ‘radio must be DAB’ mast. Digital-only stations are not proving to be as attractive to listeners as they need to be in order to drive up usage of digital platforms quickly towards the desired 50% criterion. Year-on-year, hours listened to national digital-only stations are down 7%, yet DAB receiver ownership increased by 35% over the same period, according to RAJAR. In aggregate, 16 national digital-only stations accounted for 33 million hours listening per week last quarter, a drop in the ocean compared to radio’s total 1 billion hours listened per week.

Digital-only stations are not proving to be as attractive to listeners as they need to be in order to drive up usage of digital platforms quickly towards the desired 50% criterion. Year-on-year, hours listened to national digital-only stations are down 7%, yet DAB receiver ownership increased by 35% over the same period, according to RAJAR. In aggregate, 16 national digital-only stations accounted for 33 million hours listening per week last quarter, a drop in the ocean compared to radio’s total 1 billion hours listened per week.

So, the reason it might have been so quiet today on the digital radio PR front is that there really was not much good news from RAJAR to be shouting about, from either the BBC or commercial radio perspective. And the plan laid out in the Digital Britain document, which might look great in theory, still depends upon:

- increased consumer expenditure on DAB radio hardware

- increased investment in DAB content

- increased investment in DAB transmission infrastructure

and thus does not appear to be a plan at all steeped in reality, in a time when discretionary expenditure (personal and corporate) is less forthcoming than ever.

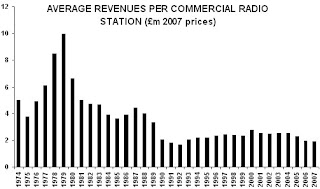

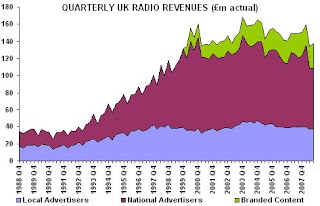

The priority for the radio industry in 2009 must be survival, pure and simple. For commercial radio, it is survival in the worsening struggle against the twin evils of falling listening and declining revenues. For the BBC, it is the struggle to ensure that the commercial radio sector survives. Without a successful commercial radio sector, the BBC’s own radio services could be under threat.

Let us hope that the Final Report for Digital Britain incorporates a greater dose of realism and pragmatism, or unfolding events might easily catch up with it even before its publication.

It hardly inspires confidence in the Digital One DAB platform that Global Radio’s predecessor, GCap Media, closed three of its own digital-only stations carried on its platform last year, and sold Planet Rock to an entrepreneur with no other radio interests. Neither is it a good advertisement for Digital One that its

It hardly inspires confidence in the Digital One DAB platform that Global Radio’s predecessor, GCap Media, closed three of its own digital-only stations carried on its platform last year, and sold Planet Rock to an entrepreneur with no other radio interests. Neither is it a good advertisement for Digital One that its