Westminster eForum Parliamentary Reception

Terrace Pavilion, House of Commons, London

28 October 2009 @ 1600

“The informal discussion that takes place can be expected to cross a range of current policy issues but the chosen theme is digital switchover and DAB.”

JOHN WHITTINGDALE MP, Chairman, House of Commons Culture, Media & Sport Select Committee:

The future of radio is very much a topic under debate. My Select Committee is currently conducting an inquiry into the future of local and regional media, of which radio is an absolutely critical part. So yesterday we were hearing evidence from Andrew Harrison of RadioCentre, Travis Baxter [of Bauer Media] who is here somewhere today, and Steve Fountain from KM Group. And we are very much aware of the pressures on commercial radio and the difficulties faced. But, at the same time, there are opportunities. And when Digital Britain came out, much of it had been trailed in advance, a lot of it quite controversial – things like top-slicing and file-sharing legislation – but the one bit which came as something of a surprise, I think, was the announcement of the date for Digital Radio Upgrade. Certainly, when I saw that in the Report, my immediate reaction was rather like the ‘Yes Minister’ Permanent Secretary who said: “That is a very brave decision, Minister”.

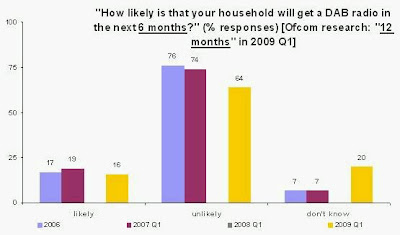

It is going to be challenging. It is slightly controversial. Not everybody in the industry is 100% yet signed up to it. Equally, there is a cost attached and we can have interesting debates about who is going to pick up the bill for it. And there will be quite a task to persuade people. In the same way that we had to work hard to persuade people that analogue switch-off of television was going to be beneficial, I think the task to persuade people in the case of radio is going to be even greater, particularly whilst we still have the overwhelming majority of cars with analogue radios in them. So there are challenges, but equally there are going to be benefits.

We heard yesterday about the costs to radio of having to transmit simultaneously in both analogue and digital and, clearly, that is something which would be reduced if we managed to get switchover. So this is a very important debate and I am keen that, when we come to debate the Digital Economy Bill when it is introduced, we should not overlook radio. There is always a danger that everybody focuses on television and there will be a huge argument about whether or not the BBC should be the exclusive recipient of the Licence Fee, and whether or not we should be trying to stop teenagers in bedrooms file-sharing, but it is important we should also debate radio and, certainly, that is something which I will try and do my best to ensure happens. But I think this afternoon is a good start to that and it is good to see so many people from the industry assembled in one room. So that’s enough from me, just to say welcome to the reception this afternoon …..

PAUL EATON, Head of Radio, Arqiva:

I would like to welcome you all as well on behalf of Arqiva and Digital Radio UK. Arqiva is part of Digital Radio UK, with the BBC and commercial radio, and I am very pleased to be joined today by Andrew Harrison, chief executive of RadioCentre, and Tim Davie, director of Audio & Music at the BBC.

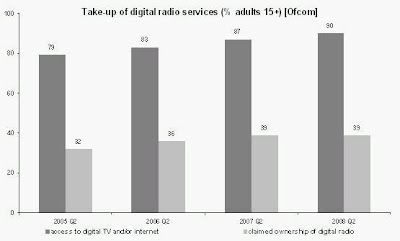

Digital Radio UK has been formed by the radio industry to get the UK ready for the Digital Radio Upgrade. That upgrade is vital because radio faces a stark choice – we can either stay in the analogue world or we can move forward into the digital one. Both need considerable investment from all of the players but only one, digital, can give radio that exciting future that listeners deserve. Digital radio will mean more choice, a better quality listening experience and the kind of interactivity that we can only dream about today.

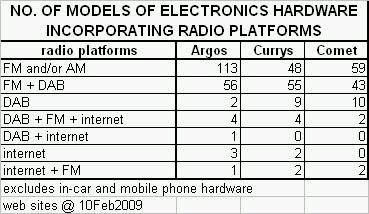

We all know that the road ahead is a difficult one. We know that the coverage is not good enough yet, we know that we haven’t got digital radio in enough cars, and we know that we need to get converters onto the market to turn analogue radios into digital ones – set-top boxes for radio, if you like. We know that there is new content and new services that need to go digital. So there’s a lot to do. But, in creating Digital Radio UK, the radio industry is demonstrating that it is serious about the digital future and is determined to address the issues and, in doing so, give the digital future that listeners deserve.….

SIMON MAYO, Presenter, BBC Five Live:

I had one of those “blimey, you’re old” moments this morning. I was talking about radio with my son – my eldest son is eighteen – and I asked him what he listened to and what his friends listen to. He thought for a moment and then he said “none of my friends have got a radio”. I thought that was quite an astonishing moment. Now, obviously, he is an unrepresentative sample of one, that is true. They kind of know about radio and they might listen online, and it’s on in the kitchen and they hear it in the car and they have an opinion of [BBC Radio One breakfast presenter] Chris Moyles, but that was it. It occurred to me that, really, radio has got a bit of a fight on its hands, which is where the kit here [points to display of DAB radio receivers] comes in, I think.

My parents’ generation didn’t need to be told that radio was fantastic. My father, if he was here, would talk about listening to Richard Dimbleby and Wynford Vaughan-Thomas and The Goons. The Goons generation didn’t need to be told that radio was great. The 60s generation didn’t need to be told that radio was great – they had the pirates, then they had Radio One. My generation fell asleep listening to the Radio Luxembourg Top 40 on a Tuesday night. It finished at 11 o’clock and that was quite daring – I see a few people nodding. That was quite daring staying up to 11 o’clock, and the fact that is was sponsored by Peter Stuyvesant cigarettes was even more dangerous. But we remembered it and we fell in love with radio, and I think there is a job to be done to make future generations fall in love with radio.

So enter digital. Partly that has to be done by the broadcasters in coming up with exciting new stations filling gaps that don’t exist. BBC7 is wonderful. Everybody will have their own particular favourites. Absolute Classic Rock is really rather good. If you want Supertramp and Led Zeppelin any time of the day, that’s the place to go. Really good stuff. There are some really big gaps that need to be filled, but that’s exciting. Analogue is full, so digital is the place to be.

But the kit is really exciting. If you have a radio when you are listening to a piece of music …. and you’re listening to the radio and an Angelic Upstarts track comes on, you press a button and it sends you an e-mail that tells you that they have reformed, you can buy their records and this is where they are playing. Or someone is listening to ‘Yesterday In Parliament’ and they hear a speech from a parliamentarian that they like, and they think “he’s interesting, she’s interesting”, press a button, you get sent an e-mail and it tells you who it is, how you can contact them – this sounds quite exciting. If you are listening to one of [presenter] Mark Kermode’s film reviews on Five Live, and you like the sound of the film, you press a button, and its sends you an e-mail, you go to your in-box and it’s got an e-mail telling you where that film is on, how you can go to see it, maybe a link to the trailer. All of that kind of information means that radio has got an exciting future, but it just means that we have to go out and explain it a bit more because people might not get it the way they used to.

Hopefully, there is still a role for the humble presenter. So you do a little bit as well. Thank you very much indeed for coming…..

[A Digital Radio UK factsheet entitled “A briefing on the digital radio upgrade” was distributed at the event. Click here to view.]